Last year's revenue exceeded 50 billion yuan, and the highest increase on the first day of IPO was only 1.67%. There are many worries behind the listing of Jitu | IPO Observation

Author | Chen SiyuanEditor | Yuan SilaiAfter waiting for 3 months, on October 27th, Jitu finally officially listed on the Hong Kong Stock Exchange. The announcement shows that the company issued 326

Author | Chen Siyuan

Editor | Yuan Silai

After waiting for 3 months, on October 27th, Jitu finally officially listed on the Hong Kong Stock Exchange. The announcement shows that the company issued 326.55 million shares, priced at HKD 12.0 per share, with 200 shares per transaction, resulting in a net proceeds of approximately HKD 3.5279 billion.

On the day of its listing, the highest price of Jitu was HKD 12.2, and its closing price fell back to HKD 12, with a total market value of HKD 105.7 billion (approximately HKD 98.914 billion).

According to previous news, Jitu plans to submit up to $1 billion in Hong Kong IPO applications, which is twice the fundraising amount. This fundraising amount may differ significantly from Jitu's initial expectations.

This rabbit, which originated in Southeast Asia, has grown into an international logistics giant with business markets covering Southeast Asia, China, the Middle East, and Latin America within 8 years.

After returning to the Chinese market, relying on subsidies, OV series agency models, and Pinduoduo support, Jitu quickly opened a crack in the almost completely competitive domestic market. After two major acquisitions by Baishi Express and Fengwang Express, in just four years, Jitu has become the sixth largest courier company in the country.

But behind the achievements of Jitu are accumulated pain and hidden crises. As a latecomer, low-priced subsidies are the simplest and quickest way to achieve results, which has also led to the continuous loss of blood and difficulty in making profits in the Chinese market.

Since the beginning of this year, logistics giants have been making constant moves to sea. Overseas has become a must-have for various countries. Jitu started overseas with a first mover advantage, but the strong newcomers have funds, e-commerce platforms, and aggressive speed. Although this IPO can provide timely blood transfusion for Jitu, it may not solve long-term concerns.

Starting from the Kingdom of Thousand Islands, Jianzhi refers to an international logistics enterprise

In 2015, Jitu was established in Indonesia, with founder Li Jie serving as the former CEO of OPPO Indonesia. Previously, Li Jie established a local logistics network for OPPO distribution, and later used this network to develop Jitu, occupying the first territory of Jitu in this thousand island country. In the following years, Jitu expanded its business to Southeast Asian countries such as Singapore, Malaysia, and Thailand.

Jitu, which has established a foothold in Southeast Asia, quickly turned its attention to China. In 2019, Jitu obtained business qualifications through the acquisition of Longbang Express, and then entered the Chinese express delivery market the following year. It reached a strategic partnership with Pinduoduo, contracting most of the latter's express delivery business. At the same time, learning from its' subsidy strategy ', we processed over 2 billion packages in 10 months using a low price starting quantity approach.

In 2022, Jitu expanded its territory again, expanding its business scope to Saudi Arabia, the United Arab Emirates, Egypt, Mexico, and Brazil. The development of new markets has brought new growth space to Jitu, with a package volume of 83.2 million pieces in the six months ended June 30, 2023.

At present, Jitu has conducted local business in 13 countries, including East Asia, Southeast Asia, the Middle East, and Latin America, covering all continents except Australia and the North and South Poles.

The inspiration comes from the "regional proxy model" of the step-by-step system, which is a major tool to help Jitu quickly start and expand its network in a short period of time.

This model was established when Duan Yongping, the founder of Bubugao, created the Little Overlord Learning Machine, which includes a first level agent in each province, a second level agent in charge of prefecture level cities, a third level agent in charge of counties and districts, and a fourth level agent in charge of townships and towns. This model incentivizes franchisees to use their own funds and resources to help headquarters expand their network with generous returns, while also encouraging franchisees to strive for regional agents.

Backed by the accumulated reputation and the network of OPPO and vivo, the process of promoting the regional agency model of Jitu is relatively smooth. In four years, Jitu expanded to seven Southeast Asian countries and became the second largest express delivery company. When returning to China in 2020, this system helped Jitu achieve nationwide coverage within two months and completed a package volume of 2.083 billion pieces in 10 months that year.

The prospectus shows that Jitu has achieved revenue growth for three consecutive years, from $1.535 billion in 2020 to $7.267 billion in 2022. The total number of packages handled is also steadily increasing, from 3.2 billion in 2020 to 14.6 billion in 2022, with a data of 7.967 billion in the first half of this year.

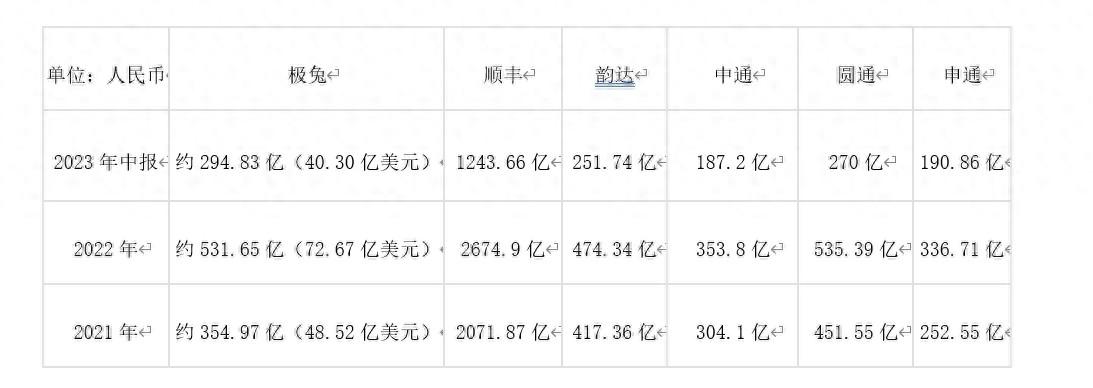

Comparison of revenue between Jitu, SF Express, and Tongda series, data from prospectus and various financial reports, 36 Kr mapping

Jitu told a good story for the capital market with its soaring performance, earning a total financing of over 5.5 billion US dollars. According to the prospectus, since 2017, Jitu has received a total of 7 rounds of investment. According to the latest news, Jitu launched its IPO on the 16th of this month, with nine cornerstone investments including Tencent, Sequoia, and Boyu Capital subscribing for a total amount of $199.5 million.

Crisis and bitterness behind singing high

Apart from revenue and package volume, Jitu's performance in other data is not impressive.

The continuous surge in income corresponds to a slightly lower but still high loss. In 2020, 2021, 2022, and the first six months of 2023, the net losses incurred by Jitu were $664 million, $6192 million, $1.573 billion, and $667 million, respectively. The previous low-priced strategy and rapid expansion have also brought significant economic burden to Jitu. From 2020 to 2022, Jitu's total current liabilities were as high as $1.147 billion, $2.206 billion, and $1.732 billion, respectively. In the first half of 2023, the data increased to $1.921 billion, while the net current asset value during the same period was $827 million.

There are three markets where Jitu operates locally: Southeast Asia, China, and New Markets (Middle East and Latin America). Southeast Asia is the only market that is still profitable, but its growth rate has slowed in recent years, transitioning from its primary market to the second largest market. The Chinese market has grown rapidly and has become the primary market for polar rabbits, but has never been profitable. The revenue from cross-border services and express delivery services in other regions was profitable in 2020 and 2021, but later fell back to a loss state in 2022 and the first half of this year due to the impact of expenses required to explore new markets.

Market revenue and proportion of each region, illustrated in the prospectus

Gross profit (gross loss) and gross profit margin (gross loss rate) of each regional market, as stated in the Tuyuan prospectus

Operating costs and proportion of each market, as shown in the prospectus

From the perspective of single ticket price and single ticket cost, the average single ticket revenue of Jitu in the Southeast Asian market and the Chinese market in the past three years is 0.99 US dollars/piece and 0.28 US dollars/piece, respectively, while the average single ticket cost in the past three years is 0.73 US dollars/piece and 0.44 US dollars/piece, respectively,This means that Jitu can make a profit of $0.26 per order in Southeast Asia, and a loss of $0.16 per order in China.

Compared to peers,According to the research report of Dongfang Securities, the single ticket prices of each company in the domestic market in 2022 are: SF Express (15.73 yuan), Yuantong (2.59 yuan), Yunda (2.55 yuan), Shentong (2.52 yuan), and Zhongtong (1.34 yuan), while Jitu is 2.49 yuan (0.34 US dollars).From this perspective, after the previous price war, Jitu still follows the low-priced route.

Average single ticket revenue and cost, Tuyuan prospectus

Express logistics is a "very hardworking, no gain" industry, seemingly simple "merchant transit station customer" route, behind which is a large amount of investment in logistics network, warehouse construction, operation management, and other aspects.According to the prospectus, performance costs and mainline costs have always been the main sources of operating costs, accounting for over 65% of the total. The proportion in the first six months of 2023 was even as high as 76.3%. Cainiao, which is currently applying for listing, has a performance cost (including mainline costs) of over 85% in the past three years.

Therefore, the express delivery industry places great emphasis on "quantity". From the perspective of marginal cost, the more the quantity, the finer the shared cost and the more income. However, before starting production, a large amount of funds need to be invested in infrastructure and terminal logistics network construction. This is also the reason why Jitu is still in a loss state in the Chinese market with revenue exceeding 10 billion yuan and has fallen back to a loss state in new markets. The reason for maintaining profitability in the Southeast Asian market is partly due to the network established by OPPO before, and on the other hand, Jitu has been in the market for many years and no longer needs to spend more on infrastructure.

In addition to internal heartbreak, Jitu also faces the perilous external environment.

Regardless of the high-end positioning of SF Express and Tongda Group, which focuses on the domestic market, Cainiao, who is also applying for listing on the Hong Kong Stock Exchange, has formed a certain competitive relationship with Jitu in terms of business and capital markets. One relies on Alibaba, and the other cooperates with Pinduoduo, forming a duopoly situation.

The growth of the Southeast Asian market, which is the only profitable market for Jitu, has also fallen into a sluggish state. The revenue of this market in 2022 increased by only $04.2 million compared to last year, and the package volume increased by only 352 million pieces. In addition, the initial birthplace of Jitu, Indonesia, recently issued e-commerce related bans, as well as previous restrictions on foreign ownership in Indonesian law, which have had an impact on Jitu's local business in Indonesia. Jitu will be prohibited from providing any pickup or delivery services outside the provincial capital, and it has a large amount of business outside the provincial capital city.

Finally, the expectations of the capital market are not hot. After all, the Hong Kong stock market is still recovering after a sharp decline, with insufficient momentum. The total market value of listed companies on the Hong Kong Stock Exchange has dropped by one-third compared to its peak in mid-2021, with the total market value evaporating over $2 trillion. The overall capital environment is such that it is difficult for Jitu to stand out alone.

Where will the future go

The seemingly stable pattern of the express delivery industry is constantly flooded with water.

Market saturation combined with a downward economic environment has led to a downward trend in the single ticket revenue of Tongda and SF since the beginning of this year, which also means that each company has to explore new markets and businesses.

Especially overseas, Cainiao has expanded its "instant delivery" service of Cainiao International Express to 18 cities in China, and in September, it teamed up with AliExpress to launch the "Global 5-Day Delivery" international express line product; SF Express sold Fengwang, invested in Jitu, and upgraded its next-day delivery services from Southeast Asia to China, while JD Logistics proposed a "three-year plan" overseas. The competition in the overseas logistics market will be even more fierce, which is not good news for Jitu.

Facing the increasingly refined and intense track, Jitu needs to slow down slightly.

On the one hand, the polar rabbit that can establish a foothold in Indonesia, a country with complex logistics conditions, and the Latin American market with frequent logistics chaos, has its advantages. Faced with the largest Chinese market and the rapidly developing Latin American market, Jitu needs to show the perseverance to bite into the Indonesian and Latin American markets, maintain the Chinese market, and stabilize the achievements of Latin America.

Moreover, e-commerce platforms are supported by logistics systems, and logistics enterprises need traffic support from e-commerce platforms. To promote internationalization, Jitu needs greater traffic support. At this point, you can take advantage of the east wind of Temu and seize more market share. At the same time, choosing to cooperate with other e-commerce giants is also a feasible strategy.

More importantly, there is little room for low prices in the domestic market, and burning money to wage price wars is not a long-term solution. Jitu needs to improve quality and increase single ticket costs sooner or later.

All of the above require huge financial support. The success of this IPO fundraising will determine how much ammunition Jitu can have, and it is also the key to whether it can create another surprise attack.

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.(Email:[email protected])