Can the leader of the "Fruit Chain" seek new growth points and leverage Huawei to overcome the downturn?

Source of this article: Time Weekly Author: Yang LinglingA year has passed, and although the leader of the "Fruit Chain", Geer Stock (002241. SZ), has not completely overcome the shadow of Apple's order cutting, there have been signs of performance recovery under positive factors such as the "Huawei Industrial Chain Concept"

Source of this article: Time Weekly Author: Yang Lingling

A year has passed, and although the leader of the "Fruit Chain", Geer Stock (002241. SZ), has not completely overcome the shadow of Apple's order cutting, there have been signs of performance recovery under positive factors such as the "Huawei Industrial Chain Concept".

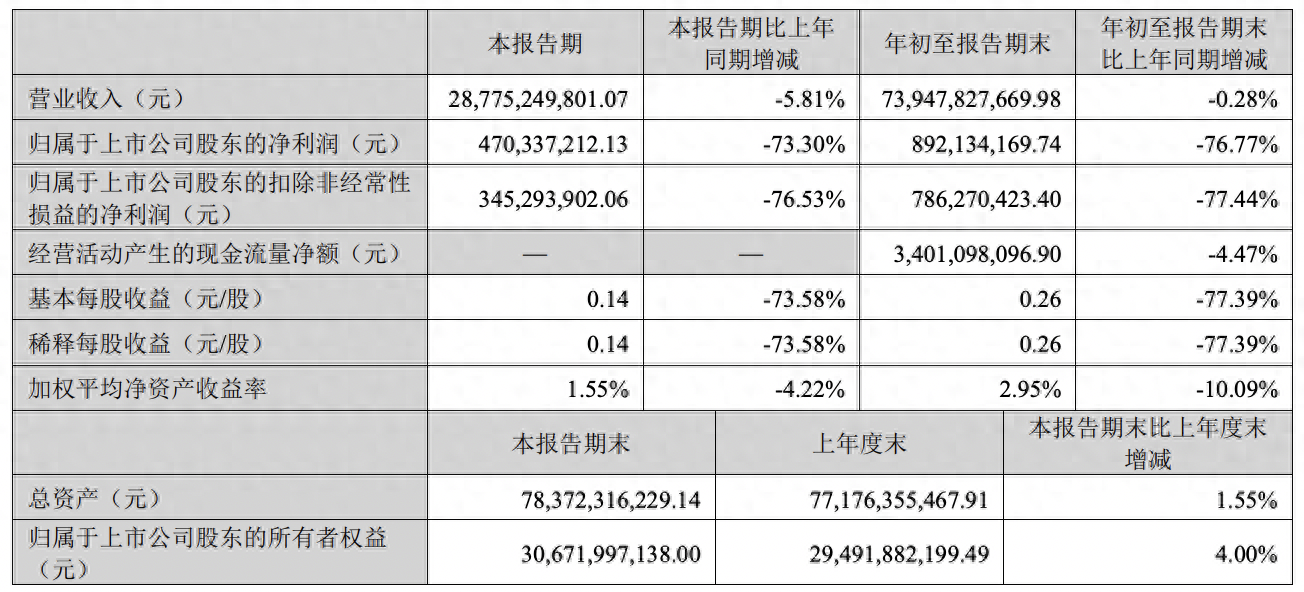

On the evening of October 26th, Geely Holdings released financial reports, with revenue of 73.948 billion yuan in the first three quarters, a year-on-year decrease of 0.28%; The net profit attributable to the parent company was 892 million yuan, a year-on-year decrease of 76.77%.

Source: Financial Reports of Listed Companies

In a single quarter, Geely's performance in the third quarter has shown a recovery trend, with a revenue of 28.775 billion yuan, an increase of 36.69% compared to the previous quarter; The net profit attributable to the parent company was 470 million yuan, a month on month increase of 48.73%. Its net profit attributable to the parent company of 470 million yuan in the third quarter has exceeded the company's net profit attributable to the parent company of 422 million yuan in the first half of the year.

Due to macro industry factors in the first half of the year, the terminal demand for some products did not meet expectations, which has had a certain impact on the comprehensive profitability in the short term. In the third quarter, some projects showed some improvement, and the overall comprehensive gross profit margin improved. With stable revenue scale, profitability continued to improve month on month. "On October 27th, the relevant person in charge of Goethe stock division replied to a reporter from Time Weekly.

Goer Stock was founded in June 2001 by Shandong entrepreneur Jiang Bin and his wife. In the past few years, Goethe's stock market has been widely known as a celebrity stock on the Fruit Chain. Relying on Apple, Geer's stock market once rose rapidly. Now, how to get rid of the impact of Apple's order cutting and find new business support has become a problem that Geer's chairman Jiang Bin needs to face directly.

On the day of the release of the third quarter report, a notice titled "Announcement on Chairman's Proposal to Repurchase Company Shares" was simultaneously released by Geer's shares. According to Jiang Bin, the chairman of the company, he proposed to repurchase the shares for 500 million to 700 million yuan, with a repurchase price not exceeding 25.49 yuan per share, for use in the company's employee shareholding plan or equity incentive plan.

For this repurchase plan, Goethe shares have replied to Times Weekly that the stock repurchase reflects the company's confidence in future long-term development and is intended for future employee stock ownership plans or equity incentives.

As of the close on October 27th, Geely's stock index rose slightly by 0.87% to 17.43 yuan per share, with the latest market value of 59.62 billion yuan.

not yetStep out of the impact of cutting orders

Times Weekly reporter flipped through the financial report and found that over the past 10 years, Geely's stock has maintained a high revenue growth rate. From 2013 to 2022, except for 2018, Geely's operating revenue in other years showed positive growth, increasing from 10.049 billion yuan in 2013 to 104.894 billion yuan in 2022, a growth of more than nine times.

Unfortunately, the company's profitability has not been directly proportional to its revenue growth rate. Data shows that the net profit attributable to the parent company of Goethe's shares increased slightly from 1.307 billion yuan in 2013 to 1.749 billion yuan in 2022, an increase of only 33.82%.

It is particularly worth mentioning that in a single quarter, from the fourth quarter of last year to the third quarter of this year, the net profit attributable to the parent company of Geer shares has been declining for four consecutive quarters year-on-year, which may be closely related to the Apple order cutting incident that Geer shares encountered last year.

On November 8, 2022, Geely announced that it had received a notice from a major overseas customer to suspend the production of one of its intelligent acoustic complete machine products. At that time, Guo Mingyi, an analyst at Tianfeng International, believed that the product that was temporarily suspended from production might be Apple's AirPodsPro2, and that the suspension of production by Geely was more likely due to production issues rather than demand issues.

Image source: Image insect creativity

Subsequently, on December 2nd, Geely announced once again that due to the aforementioned issues, its operating revenue for 2022 decreased by no more than 3.3 billion yuan, and the related direct losses were about 900 million yuan (including direct profit reduction and shutdown losses). The confirmed impairment loss is expected to be about 1.1-15 billion yuan (including inventory depreciation loss of about 700-90 million yuan and fixed asset impairment loss of about 400-60 million yuan); The total impact on profits is approximately 2 to 2.4 billion yuan.

On May 10th of this year, Goethe revealed at the 2022 annual shareholders' meeting that the aforementioned production suspension has not resumed until the first quarter of 2023, and related customer communication work is still ongoing. Except for this project, all other business collaborations with the client are ongoing normally.

On October 27th, in response to the latest progress of the project, Geer Stock responded to a reporter from Time Weekly: "Due to confidentiality requirements with customers, it is not convenient to disclose customer related information. Geer Stock closely follows industry trends, maintains continuous cooperation with international major customers, repairs major customer orders, and actively cultivates' new orders' to open up new opportunities for performance growth

In recent years, fruit chain companies have actively tried to break free from Apple dependence, and the same is true for Goethe stock market. Data shows that from 2019 to 2022, the sales of Apple, the largest customer, increased from 14.288 billion yuan to 32.642 billion yuan, but its proportion in the annual total sales decreased from 40.65% in 2019 to 31.12% in 2022.

Recently, Goethe's shares were simultaneously included in the category of "Huawei's industrial chain concept". According to market news, the shipment volume of Huawei Mate60 series in 2023 has been increased to 20 million units, and the overall shipment volume of Huawei smartphones in 2024 may reach 60-70 million units.

Source: Photographed by a reporter from Times Weekly

According to media reports, Geer is a supplier of Huawei Mate60 series acoustics, and Geer Acoustics Industrial Park in Weifang, Shandong has started to increase recruitment due to receiving a large order from Huawei.

The official website of the Star Flash Alliance also shows that Goethe is still a member unit of the alliance. Previously, an investor asked Geer Stock, "I heard that Huawei's flash headphones are produced by Geer, why hasn't the company made an announcement?" In response to this question, Geer Stock's answer was that it is not convenient to comment on specific customer or project related questions.

On October 27th, regarding Huawei's business dealings with the company, The person in charge of Geer's stock division replied to a reporter from Time Weekly: "Due to confidentiality requirements with customers, it is not convenient to disclose their relevant information. Geer's stock division has established long-term strategic partnerships with many globally renowned enterprises. As the consumer electronics industry enters a recovery cycle, Geer's stock will comprehensively improve its technological level in research and development, materials, processes, equipment, and other fields, further consolidating and expanding its competitive advantage in relevant segmented markets

Searching for the Second Growth Curve

Goer Group was established in June 2001 and listed on the Shenzhen Stock Exchange in May 2008. It is mainly engaged in the research and development, manufacturing, and sales of precision components and structural components, intelligent machines, and high-end equipment for sound and optoelectronics.

Looking back at the development history of Goethe stock, the company entered the Apple industry chain in 2010 and became a mainstream supplier of Apple headphones, micro speakers, and micro microphones. In 2018, Goethe won 30% of Apple's AirPods OEM share, becoming the world's second largest AirPods OEM factory.

In the mobile phone industry, there has always been a saying that "Apple eats meat, suppliers drink soup". In recent years, supplier companies have also begun to show performance such as "increasing income without increasing profits" and "stock price fluctuations".

In response to the widely criticized dependence on large clients, Goethe started its strategic transformation in 2012, seeking a second growth curve. Ge Er Fen is one of the long-distance runners in the virtual reality track. Since 2012, with its first mover advantage and abundant customer acquisition, it has now occupied an absolute share of global mid to high-end VR product shipments. "The relevant person in charge of Ge Er Fen told Times Weekly.

Image source: Image insect creativity

Zhongtai Securities mentioned in a research report that in the VR/AR field, Goethe is an exclusive/core OEM manufacturer for leading manufacturers such as Meta, Pico, and Sony. In the intelligent wearable field, it has accumulated rich customer resources such as Huawei, Fitbit, and Sony. In addition, it also provides game console OEM services for manufacturers such as Sony.

The main business of Goer Stock includes precision component business, intelligent acoustic complete machine business, and intelligent hardware business. According to financial report data, by 2021, the revenue of Geer's intelligent hardware business will continue to rise, completing the reverse expansion of its intelligent acoustic complete machine business; In 2022, the revenue of the intelligent hardware business nearly doubled year-on-year, accounting for 60% of the company's revenue.

At the same time, the person in charge of Goethe's stock division told Time Weekly that the company is actively exploring business opportunities related to automotive electronics. This year, it has launched a new generation of DLP technology PGU modules for in car AR-HUD, accelerating its expansion in the field of automotive intelligent cockpit optics.

In April of this year, Geer Group also established a company in Chongqing, named "Chongqing Geer Zhixing Technology Co., Ltd." for the research and development of automotive components, onboard intelligent devices, and related intelligent algorithms, to further expand the automotive electronics industry.

In the long run, Goethe will seize opportunities in industries such as the metaverse and new energy vehicles, continuously increase investment in research and development costs, and incubate new growth points for performance by increasing industrial layout and strengthening technological innovation, "said the person in charge of Goethe's stock division.

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.(Email:[email protected])