Huawei's total debt has exceeded the 700 billion yuan mark, reaching a new historical high!

Huawei released its third quarter report at the end of October, and most of us are focused on Huawei's net profit, but have overlooked Huawei's total liabilities.Huawei's revenue in the first three quarters of this year was 456

Huawei released its third quarter report at the end of October, and most of us are focused on Huawei's net profit, but have overlooked Huawei's total liabilities.

Huawei's revenue in the first three quarters of this year was 456.6 billion yuan, a year-on-year increase of only 2.4%, and its net profit reached 73.056 billion yuan, a year-on-year surge of 169%. The total debt officially exceeded the 700 billion yuan mark, which is also the peak of Huawei's total debt.

On the surface, Huawei's performance in the third quarter was very good, but in reality, there are hidden secrets behind it. It is difficult for any company that has reached the revenue scale of Huawei to achieve a net profit surge of 169% even with a revenue growth of only 2.4%. The huge difference in data makes the source of profits full of suspense.

Although roast have repeatedly complained about "low allocation and high price", Huawei's net interest rate has remained at around 8%, which is also Huawei's normal net interest rate. After Huawei was blacklisted, its net profit margin in 2022 dropped to 5.54%, setting a new low in recent years. But in the third quarter of 2023, the net profit margin suddenly surged to 16%, which is also too abnormal. Therefore, we speculate that Huawei may have received money from Honor shareholders in the second and third quarters. Because Huawei sold its glory, shareholders did not make a one-time payment, but instead used installment payments.

Returning to the issue of Huawei's total liabilities, the total liabilities from 2019 to 2022 were 554 billion yuan, 537.9 billion yuan, 568.2 billion yuan, and 626.7 billion yuan, respectively. At the end of the third quarter of 2023, total liabilities increased to 704.2 billion yuan.

Through a simple comparison of data, we can see that Huawei's total liabilities have experienced rapid growth in the past two years. Before 2021, Huawei's total liabilities were around 550 billion yuan, and in 2020, there was even a decrease in total liabilities. However, in 2022, Huawei's total liabilities exceeded the 600 billion yuan mark for the first time, reaching 626.7 billion yuan. In one year, the debt increased by 58.5 billion yuan.

By 2023, Huawei's debt has increased even faster. In just 9 months, Huawei's total debt has increased by 77.5 billion yuan, with an average monthly increase of 8.6 billion yuan in debt.

Seeing these data, people are confused. Is Huawei's data good or bad? On one hand, there has been a significant increase in net profit, and on the other hand, there has been a significant increase in debt. Why is Huawei, which has made a lot of money, facing increasingly high total debt?

This is actually closely related to Huawei's situation. Huawei's revenue in 2019 and 2020 were 858.8 billion yuan and 891.4 billion yuan respectively. Although Huawei faced a shortage of chips at that time, the company's revenue was very abundant and cash flow was also sufficient.

However, after the sale of Honor, Huawei's cash flow also encountered a major crisis, and the company's approach was to issue bonds to survive. In 2019, Huawei issued mid-term notes for the first time domestically, with two issues each of 3 billion yuan, with a term of 3 years.

Afterwards, Huawei seemed to have tasted the benefits of issuing bonds domestically and continuously increased its issuance scale. According to statistics, from October 2019 to August 2022, Huawei issued a total of 47 billion yuan in medium-term notes and ultra short-term financing bills domestically. This is only a part of Huawei's borrowing.

Why should Huawei accelerate the pace of borrowing? I personally believe there are three main reasons:

Firstly, enrich cash flow. Although Huawei may occasionally receive transaction payments from Honor shareholders, this is not a long-term solution. After a significant decline in revenue and cash flow crisis, Huawei inevitably needs to "save more food". After all, having more money on the company's books can increase its ability to respond to unexpected events.

For example, in the past year, we could earn 800000 yuan and deposit 60000 yuan per year, making our lives enjoyable. But suddenly the epidemic came, and our annual income dropped to 600000 yuan. However, we have developed the habit of spending 740000 yuan annually. What should we do? Using a credit card first is a good method, and we can also slightly constrain our expenses to wait until the company's spring arrives.

Secondly, Huawei has made significant investments in recent years. According to statistics, the total amount of physical investment under construction or planned by Huawei is as high as 57.2 billion yuan, and the cloud data center built by Huawei in Guizhou alone is as high as 7.2 billion yuan.

Thirdly, Huawei's R&D investment remains fierce. Huawei's annual R&D investment is astronomical, exceeding 100 billion yuan as early as 2018, reaching 101.475 billion yuan. In 2021, it soared to 142.7 billion yuan. Huawei's advantage in technology comes from its huge R&D investment. Ren Zhengfei knows that no matter how hard it is, research and development will inevitably make Huawei's cash flow relatively tight. Moreover, Huawei has increased its investment in new energy vehicles in recent years, reaching tens of billions of yuan annually.

Overall, although Huawei's total liabilities are rapidly increasing, its total assets are also rapidly increasing, and its debt ratio remains below 70%, which is not too high or too low.

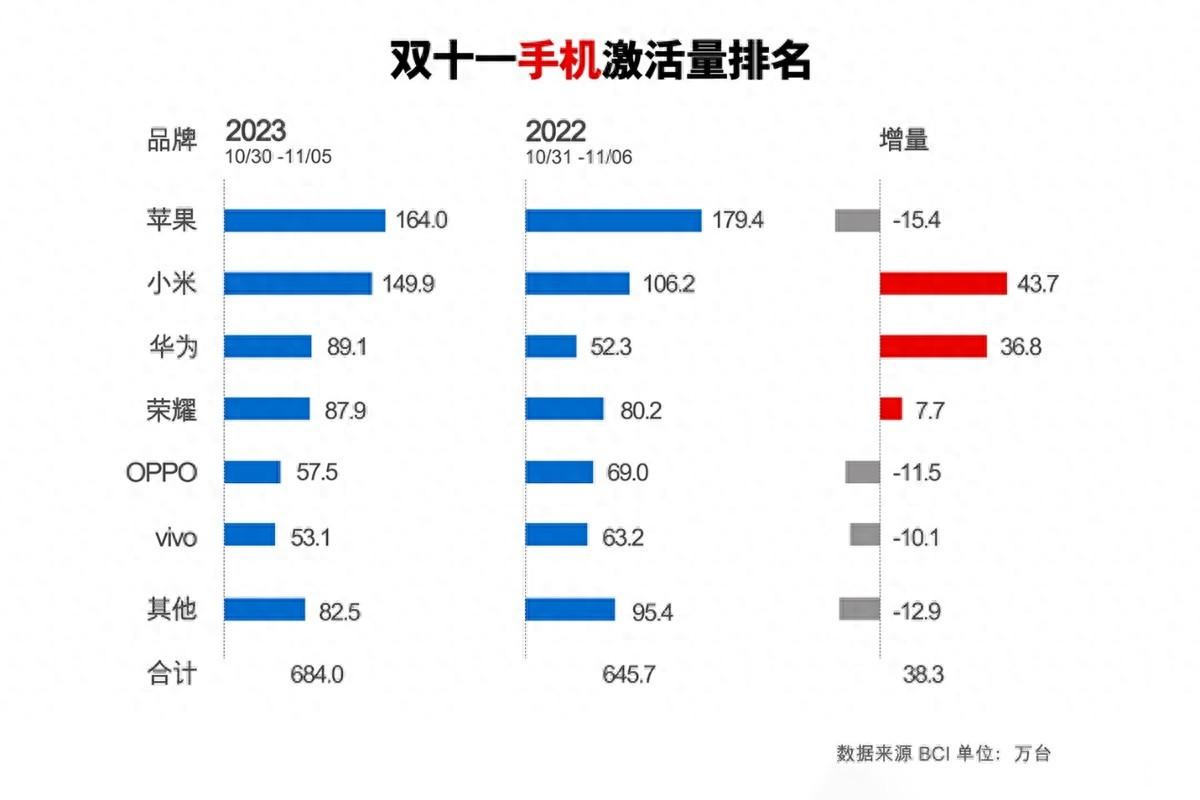

Huawei's debt ratio is expected to decline in the fourth quarter of 2023 due to the best-selling Mate60 series phones and the Wenjie New M7. Huawei's net profit in the fourth quarter is expected.

This is the best and worst era, where disruptive innovation is integrated with new business models, and the world is your stage!

In the world of new business, there are no eliminated industries, only companies that have been subverted and eliminated. Now, all business competition will focus on "subversion and reconstruction".

If a company or a boss lacks the ability to disrupt and restructure, they are destined to fail ahead of time.

Please remember: Without innovation, there is no imagination; Without imagination, there is no competitiveness; To break through the situation and break through, we must overturn the original business model and reconstruct a new business model!

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.(Email:[email protected])