A Comprehensive Analysis of Huagong Technology: A Leader in Laser Welding for AskM9 and Beyond

AskM9, a model from the Seres brand, boasts a range of advanced features, including the Huawei Intelligent Cockpit and Intelligent Driving system. However, one of its most impressive aspects is its use of laser welding technology provided by Huagong Technology

AskM9, a model from the Seres brand, boasts a range of advanced features, including the Huawei Intelligent Cockpit and Intelligent Driving system. However, one of its most impressive aspects is its use of laser welding technology provided by Huagong Technology. This cutting-edge technology has positioned Huagong Technology as a leader in its field, earning it the label of "leading the way" in the industry.

Huagong Technology's Welding Technology for AskM9

Huagong Technology's laser welding process ensures exceptional quality and efficiency for AskM9's car body. With a of over 99% and the ability to weld a car body in as little as 42.5 seconds, this technology sets new standards for the industry.

Huagong Technology: A Multifaceted Leader

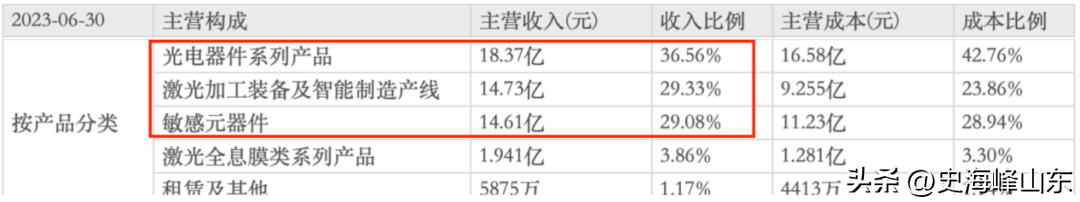

Huagong Technology's capabilities extend far beyond its laser welding expertise. The company has established itself as a leader in three distinct business segments: optoelectronic devices, laser processing equipment, and intelligent manufacturing, as well as sensitive components. Each of these segments contributes roughly 30% to the company's revenue.

Dominance in Intelligent Manufacturing

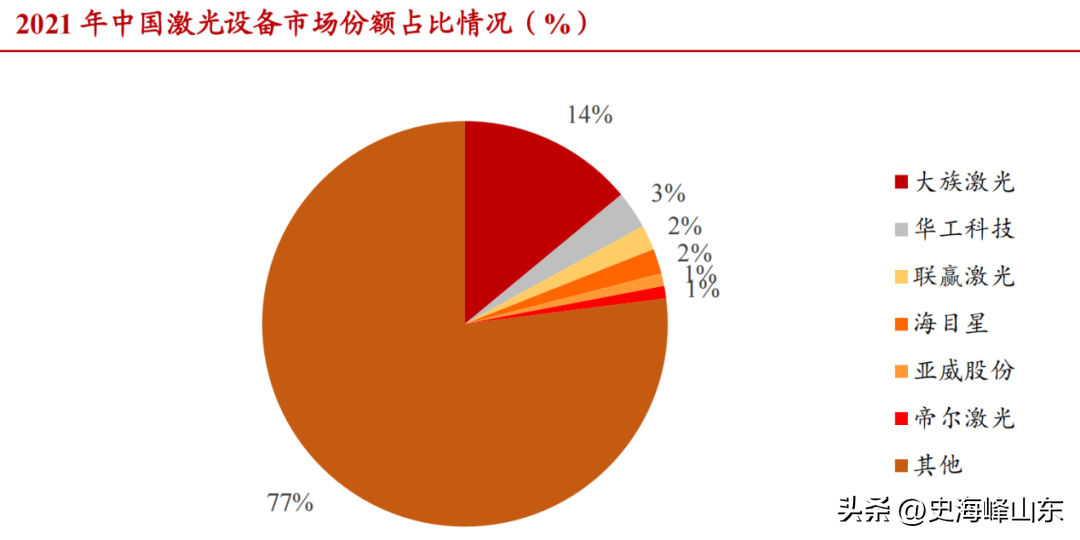

Huagong Technology's Intelligent Manufacturing segment, which specializes in the production of laser equipment, has achieved numerous milestones, including over 60 industry firsts in China. The company is one of the largest manufacturers of laser equipment in the country, with its products finding applications across various industries.

In the laser equipment segment, Huagong Technology ranks second only to Han's Laser, ahead of Lianying Laser, Haima Xing, and Awei shares. The company's three-dimensional five-axis laser cutting intelligent equipment has consistently maintained the top market share in China for many years, earning recognition from leading automotive brands such as BYD and Tesla.

In 2023, Huagong Technology successfully developed China's first wafer cutting equipment with 100% domestically produced core components. This breakthrough not only strengthens the company's core competitiveness but also significantly advances the goal of.

Strong Presence in Optical Module Market

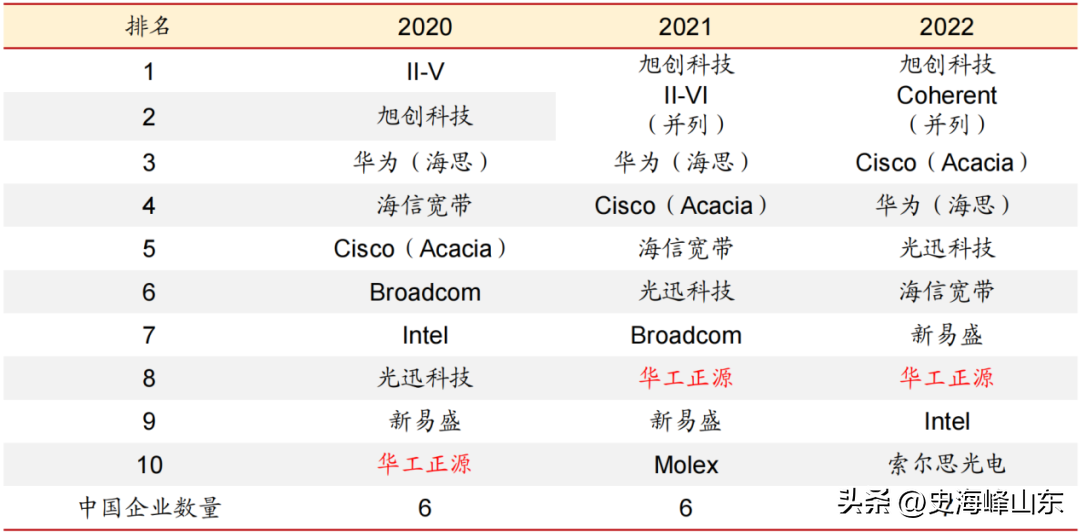

In the optical module market, Huagong Technology ranks eighth globally, up two places from 2020. While this position may seem lower than that of other industry giants such as Accelink, Huawei, Fiberhome Technologies, and Newisys, it is important to consider that optical modules are just one of the company's businesses. Notably, Huagong Technology's ranking is even higher than that of Intel.

To maintain its leading market share, Huagong Technology continuously innovates and develops new products in line with market demand. With the rapid adoption of AI applications, high-speed optical modules have become the market. Huagong Technology has already achieved mass production of 400G modules, successfully developed 800G modules, and is currently working on 1.6T and 3.2T modules. This commitment to innovation ensures that the company's product portfolio meets the current and future needs of the market.

Importantly, Huagong Technology has full R&D and production capabilities for optical chips and optical modules, eliminating any reliance on external suppliers. This allows the company to maintain control over the entire production process, ensuring quality and meeting the demands of customers such as Huawei, Alibaba, and Tencent.

Global Leader in Sensitive Components

Huagong Technology's Sensitive Components business holds a remarkable 70% market share globally. This segment primarily produces sensors, with the company's ceramic capacitor pressure sensors successfully breaking foreign technology monopolies. Additionally, the company's temperature sensors enjoy a global market share of 70%.

Building upon its temperature sensor technology, Huagong Technology independently developed a PTC heater, becoming the first domestic manufacturer in this field. PTC heaters are widely used in electric vehicles from leading brands such as SAIC, Ideal, and Weilai, with a domestic market share of 60%.

Financial Performance and Growth Prospects

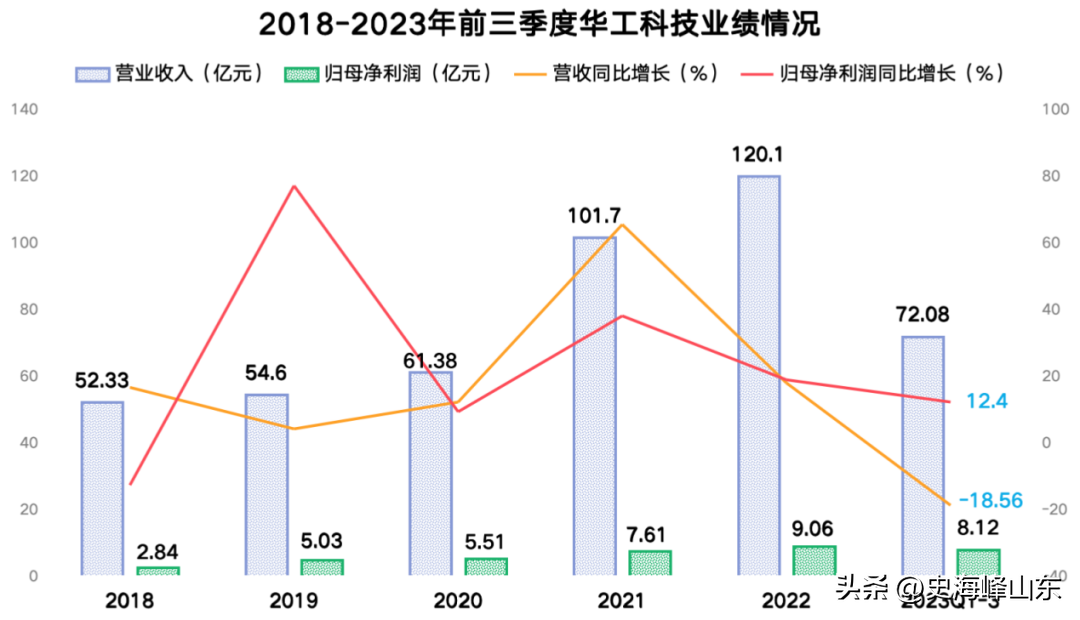

The technological and market advantages of Huagong Technology's three business segments have driven the company's steady growth in recent years. Revenue has increased from 5.233 billion yuan in 2018 to 12.01 billion yuan in 2022, while net profit has grown from 284 million yuan to 906 million yuan.

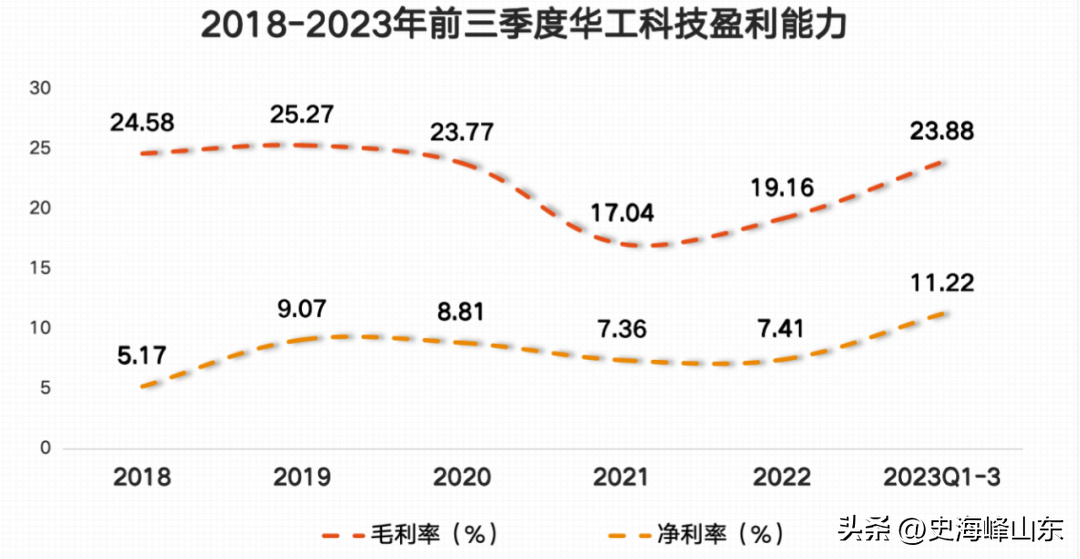

Although the company's revenue experienced a slight decline in the first three quarters of 2023 due to weakened demand, net profit still saw a year-over-year increase of 12.4%. An analysis of the company's gross and net profit margins indicates a gradual improvement in profitability, reflecting the company's increasing technological capabilities.

In terms of growth prospects, the three business segments of Huagong Technology offer significant potential.

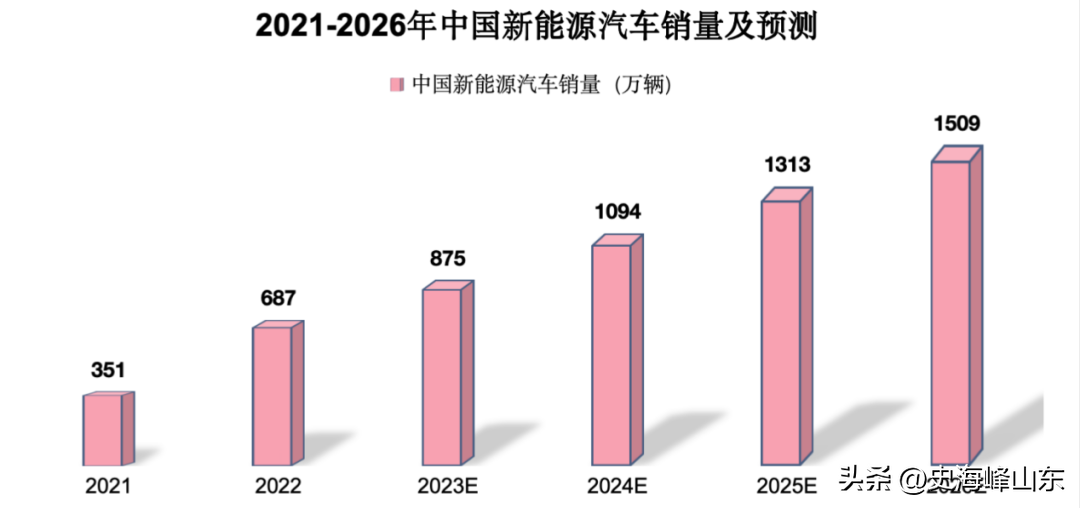

Firstly, the growth in new energy vehicle sales is expected to continue fueling demand for the company's laser equipment and sensors. In 2022, China's new energy vehicle sales reached 6.87 million units, with a penetration rate of only 27.6%. Both environmental concerns and the pursuit of suggest that the market for new energy vehicles is far from saturated.

By 2026, China's new energy vehicle sales are projected to reach 15.09 million units, representing a significant growth opportunity. This growth will drive demand for laser cutting and welding equipment. Additionally, PTC heaters are almost indispensable in electric vehicles, and the domestic market for PTC heaters is expected to expand from 158.1 billion yuan in 2022 to 300.4 billion yuan in 2026. Given Huagong Technology's dominant market share in PTC heaters, the company is well-positioned to benefit from this growth.

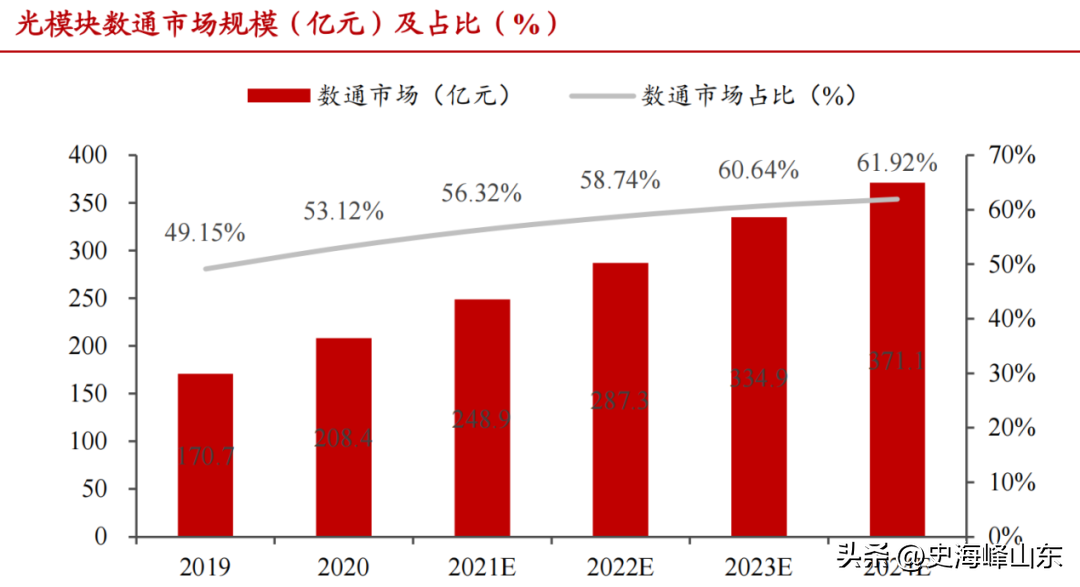

Secondly, the optical communications market offers vast potential. The two major downstream markets for optical modules are data communication and telecommunications. While demand for optical modules in the telecommunications market is expected to continue growing, the growth rate is gradually slowing down.

The primary driver of optical module demand will be the data communication market, which already accounts for over 60% of the market share. The global data communication market is projected to grow by $3.6 trillion by 2027, with a compound annual growth rate of 11% from 2020 to 2027.

High-speed optical modules are indispensable for data transmission, and the demand for 800G and higher optical modules is expected to grow exponentially. Huagong Technology's optical module business has a presence in both the data communication and telecommunications markets, and its products are among the most advanced. The company is well-positioned to benefit from the significant growth potential in this segment.

Huagong Technology's strategic focus on three distinct business segments has enabled the company to establish itself as a leader in each of these areas. The company's commitment to innovation, including its efforts towards 100% domestic production, has attracted the attention of institutional investors such as social security funds.

Looking ahead, Huagong Technology is well-positioned to capitalize on the growth opportunities in downstream markets such as data communication, telecommunications, new energy, and even most industrial manufacturing sectors. The company's strong financial performance, technological capabilities, and market share dominance make it an attractive investment for investors seeking long-term growth potential.

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.(Email:[email protected])