HP releases its outlook for the 2024 fiscal year, with profits expected to meet analysts' expectations

On October 11th, HP released its financial outlook for the 2024 fiscal year. The company expects GAAP diluted net earnings per share to be between $2

On October 11th, HP released its financial outlook for the 2024 fiscal year. The company expects GAAP diluted net earnings per share to be between $2.75 and $3.15, and non GAAP diluted net earnings per share to be between $3.25 and $3.65. Analysts had previously expected an average earnings per share of $3.47.

It is understood that HP's free cash flow forecast for the fiscal year 2024 is between $3.1 billion and $3.6 billion, higher than the average analyst forecast of $3.17 billion. In addition, HP stated that future earnings will be returned to shareholders through dividends and stock repurchases.

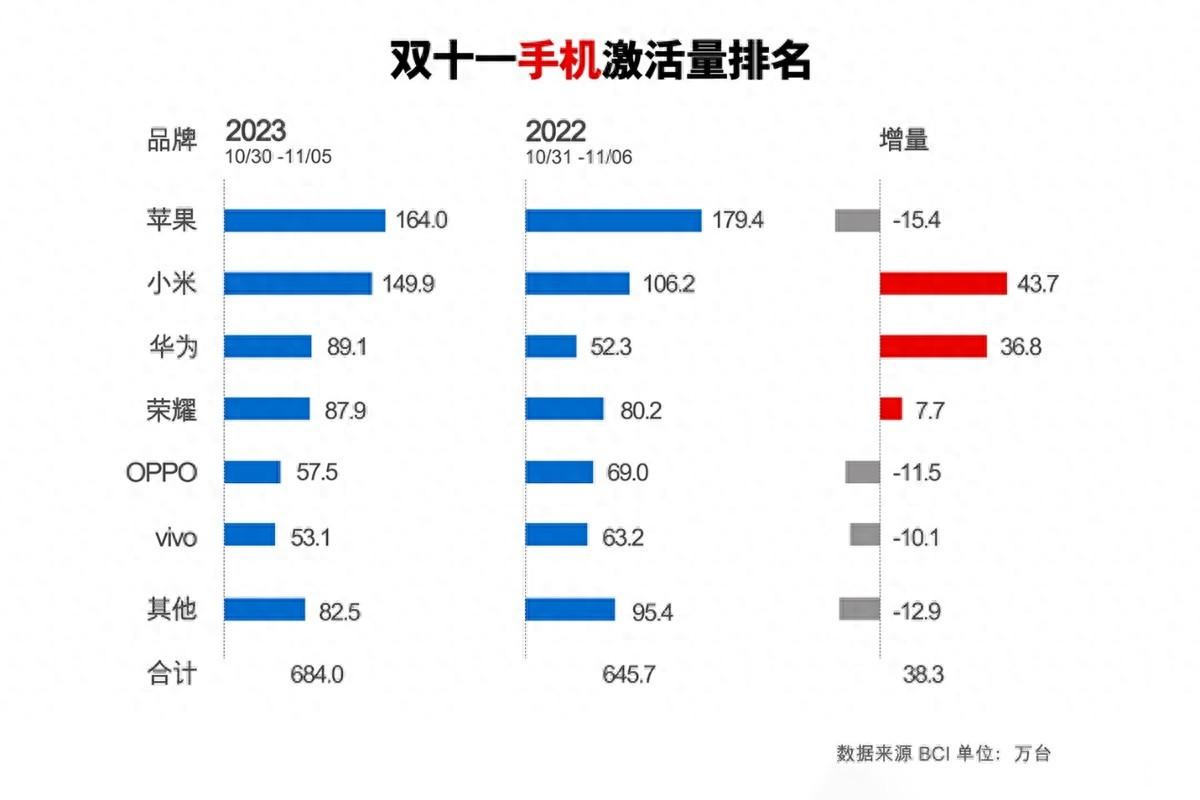

Recent statistics from Gartner and IDC both indicate that after a period of decline, the PC industry has bottomed out and is recovering. Gartner believes that after eight consecutive quarters of decline, the PC market is expected to start recovering in the fourth quarter of 2023. IDC believes that the global PC shipment volume reached 68.2 million units in the third quarter, although it still decreased by 7.6% year-on-year, the month on month growth of 11% showed a rebound trend.

HP has been hit by a decline in personal computer sales, with high inventory levels driving down prices.

HP Greater China President Zhuang Zhengsong previously stated in an interview with reporters, "We believe that the volume of the PC market is still large, and HP still has many opportunities. We will further focus on segmenting the market, sinking the market, and exploring new online channels

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.(Email:[email protected])