TikTok e-commerce is banned in Indonesia: When social and e-commerce are "cut off," is Southeast Asia still an ideal place for e-commerce to go overseas?

Reporter: Wang Ziwei Editor: Liu XuemeiThe ban on TikTok e-commerce in Indonesia has caused uproar.According to public reports, at the end of September, Indonesian President Joko Widodo officially banned direct sales transactions on social media platforms like TikTok at a cabinet meeting, and stated that the regulation would be incorporated into the revised Indonesian Ministry of Trade Regulation No

Reporter: Wang Ziwei Editor: Liu Xuemei

The ban on TikTok e-commerce in Indonesia has caused uproar.

According to public reports, at the end of September, Indonesian President Joko Widodo officially banned direct sales transactions on social media platforms like TikTok at a cabinet meeting, and stated that the regulation would be incorporated into the revised Indonesian Ministry of Trade Regulation No. 50/2020.

At present, TikTokShop in Indonesia has officially closed down.

TikTokShop in Indonesia has officially closed down. Image source: Visual China - VCG111416551032

In the Indonesian market, there are over 325 million monthly active users, of which 125 million come from TikTok in Indonesia. Currently, there is only one role left in Indonesia: for people to browse short videos. To do e-commerce, you may need to implement it through other programs or independent apps.

The Indonesian market, due to its large population and developed e-commerce, is a "fat meat" closely watched by cross-border e-commerce platforms entering the Southeast Asian market. However, the local authorities in Indonesia are also known for their strictness towards foreign cross-border e-commerce.

In July 2021, the cross-border e-commerce platform SHEIN announced the cessation of operations in Indonesia. At that time, there were reports that the e-commerce platform with SHEINPK was ZALORA, a local fashion e-commerce platform in Indonesia. A person from the cross-border e-commerce industry told the Daily Economic News that SheIn's withdrawal is related to the local "strong sense of localism".

E-commerce industry observer and mischievous e-commerce founder Feng Huakui told reporters that e-commerce is not just a simple retail, it is actually the prelude to commercial digitization; Simply restricting social media platforms to engage in e-commerce to protect local physical stores is completely useless.

But the impact of the TikTok e-commerce incident is so profound that it has caused concern for the originally ambitious cross-border e-commerce practitioners in China, who are inevitably worried that other countries in Southeast Asia will also follow suit.

In fact, there has been a new trend in Malaysia. According to public reports, on October 7th, Malaysia's Minister of Communications and Digital Affairs, Fatimi, stated that the department will call on the platform's management to provide an explanation in the near future regarding Indonesia's ban on TikTok e-commerce services and advertising content, in order to develop measures suitable for Malaysia.

For TikTok, Indonesia is a key destination for going to sea. Before choosing Southeast Asia, TikTok encountered setbacks in its development in both the United States and the United Kingdom, and later placed hope in Indonesia. TikTok has been hindered again this time, which is a huge challenge for both the company and cross-border e-commerce players in China.

TikTok's social monetization has been hindered by the closure of a small store

The shutdown of TikTokshop in Indonesia has long been a clue.

In early July of this year, Teten Masduki, the Minister of Cooperatives and Small and Medium Enterprises of the Indonesian Ministry of Small and Medium Enterprises, publicly stated on multiple occasions that TikTok harms the interests of small and medium-sized enterprises and that it is urgent to modify relevant regulations and regulations. At this stage, many Indonesian officials hold a neutral attitude towards this.

But in September, the wind changed direction. Indonesian President Joko expressed concern about the negative impact of TikTokShop on small and micro enterprises, and emphasized that TikTok should uphold its role as a social media platform.

On September 25th, the Indonesian Ministry of Trade announced that in order to regulate the country's e-commerce market, the department is intensifying the development of e-commerce regulatory policies to prohibit transactions on social media platforms.

On September 27th, the "Trade Minister's Order No. 31 of 2023" (hereinafter referred to as "Regulation No. 31") was issued, which clearly restricts social media platforms from engaging in e-commerce. This regulation specifically limits two points: firstly, it explicitly prohibits social media platforms from engaging in e-commerce; Secondly, limit the minimum price and require that only foreign products priced at least $100 can be sold through social media platforms, and these products must meet whitelist requirements.

TikTok quickly responded and stated that starting from 17:00 local time on October 4, 2023, it will no longer provide convenience for e-commerce transactions at TikTokShopIndonesia. At this point, TikTok has shut down its e-commerce business in Indonesia.

Kang Zeyu, the head of TikTok e-commerce, wrote in an internal letter that this incident happened "quite suddenly, and the underlying reasons are quite complex". The letter mentioned that TikTokShop Indonesia has served 80 million Indonesian users in the past two years. And we are still actively discussing with relevant authorities to strive for "providing services to the small and micro enterprise community in Indonesia" in the future.

This is undoubtedly a blow to TikTok's overseas planning for e-commerce. After experiencing setbacks in the UK and US markets, TikTok has targeted Southeast Asia, with Indonesia being the sector that TikTok values the most.

In February 2021, TikTok launched a small yellow car in Indonesia and subsequently launched live streaming sales.

In February 2021, TikTokShop was launched in Indonesia, marking its first entry into Southeast Asian e-commerce. In less than three years, TikTokShop has made rapid progress, covering six major countries in Southeast Asia, and has become a significant competitor to experienced major e-commerce platforms such as Lazada and Tokopedia in the region.

According to data from MomentumWorks, a consulting firm based in Singapore, Indonesia's e-commerce transaction volume in 2022 was approximately $52 billion, of which approximately $2.5 billion came from TikTok, accounting for 57% of TikTok's GMV in Southeast Asia. According to the latest report "The TikTokShopPlaybook" by Motten Venture Capital, the market share of TikTokShop is expected to reach 13.2% in 2023.

TikTok was once full of expectations and ambitious towards Indonesia. In June of this year, TikTok held the first TikTok Southeast Asian Influence Forum in the Indonesian capital Jakarta. At the meeting, TikTok CEO Zhou Shouzi stated that he will invest more than $12 million in the Southeast Asian market in the next three years to support over 120000 local merchants and enterprises. According to Zhou Shouzi, TikTok currently has approximately 8000 employees in Southeast Asia, with over 325 million monthly active users, covering nearly half of the population in Southeast Asia, of which 125 million come from Indonesia.

Where will 6 million small and medium-sized businesses go?

Shutting down a platform can affect an ecosystem.

Industry insiders told the Daily Economic News that Indonesia has strict management of cross-border e-commerce. For example, in 2021, SHEIN, which has been in the Indonesian market for over two years, announced its withdrawal from the country.

At that time, the media believed that there were two reasons for SHEIN's withdrawal. Firstly, SHEIN was unable to match the local visit volume of Indonesian fashion e-commerce ZALORA; Another reason is that Indonesia has introduced a new policy that requires all inbound e-commerce packages to include the recipient's personal or corporate identity authentication information from August 1st of that year.

Aaron Michael, a veteran of e-commerce logistics in Southeast Asia, believes in his submission to "Moton Venture Capital", which focuses on the Southeast Asian market, that this policy cannot be enforced, The integrity of the data cannot be guaranteed: "As part of measures to protect the local market and economy from the impact of imported products, the government is raising the threshold for B2C products to enter Indonesia and the B2B import costs for large wholesalers. We hope to use this measure to promote the vigorous development of Indonesian manufactured products and regain market share

For TikTokshop, Regulation No. 31 this time is almost a 'one shot lockdown'. Throughout the development of social e-commerce platforms in Indonesia, TikTok is the most mature; And this time, the Indonesian e-commerce platform has set a minimum price of $100 for goods directly purchased from abroad, and has made regulations on the certification requirements for imported goods, which has also caught TikTok's neck:

The prices of products on the TikTok platform are generally low, and they quickly penetrate the market. A report from CITIC Securities shows that the unit price for customers on TikTok is only $2-5.

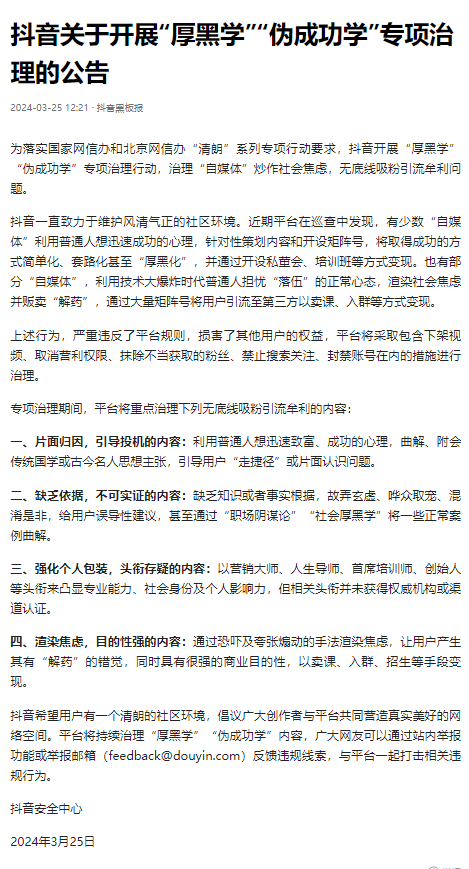

E-commerce industry observer Feng Huakui told reporters from Daily Economic News, If it is really to protect local entities, it should be to increase tariffs. Currently, restricting social media platforms from engaging in e-commerce is completely useless. E-commerce is not just a simple retail, but a prelude to commercial digitization. It can effectively promote the digital process of the commodity economy, improve efficiency, and further promote the development of the national economy

More specifically, one of the reasons for the ban is "concern about the impact on local small and medium-sized enterprises". In fact, there are millions of local small and medium-sized sellers on TikTok in Indonesia.

This ban has also caused dissatisfaction among local small and medium-sized sellers in Indonesia. According to Guangming Network, a spokesperson for TikTok Indonesia publicly responded to the new regulations in Indonesia, stating that the birth of social e-commerce is aimed at solving the practical problems of traditional local small sellers. While respecting local laws and regulations, the company also hopes that these regulations can take into account their impact on the livelihoods of over 6 million TikTokShop sellers and nearly 7 million related creators.

Veronica, Director of the China Department of the Indonesian Center for Strategic and International Studies, stated in an interview with Guangming Network that the market has its own laws. Since the COVID-19, the rapid development of Indonesian e-commerce platforms and the shift of consumers' shopping habits to online have boosted the development of Indonesia's economy to some extent. The current ban is not very friendly for some small and medium-sized enterprises that rely on or rely on e-commerce. For TikTok, it is also necessary to adapt to policy changes and find compromise solutions.

What everyone is paying attention to is: How does TikTok go next? Simply put, TikTok can do live streaming, short videos, or start another company to do e-commerce, but the two cannot be combined. It is worth noting that Indonesia does not prohibit personal live streaming and sales, but does not want the social e-commerce industry to emerge.

At present, the mainstream e-commerce platforms operating in Indonesia include Shopee, local e-commerce platforms Tokopedia, and Lazada. A reporter from Daily Economic News learned that these three platforms are actively attracting small and medium-sized sellers who have left TikTok.

Is Southeast Asia still an ideal place for cross-border trade?

A cross-border e-commerce practitioner told the Daily Economic News that cross-border e-commerce practitioners in Southeast Asia have "exploded" in the past two days, and everyone is generally concerned about whether Southeast Asian countries such as Myanmar and Malaysia will follow Indonesia's approach.

According to reference sources, after Indonesia, multiple Southeast Asian countries are also following up on the investigation of TikTok. According to foreign media reports, Vietnam has completed a nearly five month investigation into TikTok. The investigation results show that TikTok has violated multiple regulations related to e-commerce, and Vietnam requires TikTok to complete rectification within 30 days.

There are also some who are slightly conflicted. On October 7th, Malaysia's Minister of Communications and Digital Affairs, Fatimi, stated that the Malaysian government will simultaneously investigate the Indonesian government's plan to ban the social media platform TikTok from promoting e-commerce business; But on October 12th, according to foreign media reports cited by Reference News Network, on October 11th, the Chairman of the Malaysian E-commerce Commission, Ganesh Kumar Banga, stated that the ban on TikTok e-commerce would cause serious damage to small and medium-sized enterprises, short video creators, and e-commerce practitioners.

An industry insider told reporters that the dilemma for Southeast Asian countries lies in not wanting to affect local investment attraction, but also wanting to protect local small and medium-sized enterprises.

Take Indonesia as an example. According to the Beijing Business Daily, data shows that there are over 64 million small and medium-sized enterprises in Indonesia, accounting for 99.9% of the total number of Indonesian enterprises. They contribute 60.3% of the country's GDP and absorb 97% of the workforce, accounting for 99% of the total employed population.

In 2020, the local attraction for foreign investment in Indonesia has further strengthened. According to the "Overview of Indonesia's Economic and Trade Development and Market Prospects Guidelines - Feasibility Study Report on China Council for the Promotion of International Trade's 2023 Overseas Exhibition" released by the China Council for the Promotion of International Trade, in March 2021, Indonesia launched a "New Investment List" supporting the Investment Law, listing "priority industries" to replace the original negative investment list, and canceling or relaxing restrictions on foreign investment such as equity ratios in key investment areas.

In the second quarter of 2022, Indonesia attracted foreign direct investment funds (FDI) of IDR 163.2 trillion (approximately 10.89 billion US dollars), a year-on-year increase of 39.7%, the highest growth rate in the past decade. Among them, Singapore, China, and Japan are Indonesia's largest sources of external investment.

Thanks to the support of these policies, domestic e-commerce platforms and overseas sellers have been laying out their presence in the Southeast Asian market for many years, and e-commerce in the Southeast Asian region has also grown rapidly in the past two years.

According to the eMarketer report, Southeast Asian e-commerce sales in 2021 were $74.36 billion, and it is expected that by 2023, Southeast Asian e-commerce sales will exceed the $100 billion mark; According to the 2022 Southeast Asian Digital Economy Report, the total e-commerce revenue in Southeast Asia in 2022 was $131 billion, and it is expected to reach $211 billion by 2025.

TikTok, which started with short videos and has its own traffic layout in Southeast Asia, has inherent advantages in e-commerce. In 2022, it expanded TikTokShop to six Southeast Asian countries - Singapore, Malaysia, Indonesia, the Philippines, Vietnam, and Thailand. Domestic live streaming e-commerce players have also entered the Southeast Asian market on a large scale in the past two years. An industry insider engaged in cross-border e-commerce told the Daily Economic News that after the domestic supply chain matures, the competitive advantage of products is very obvious.

But the ambiguous attitude and recent tense atmosphere in Southeast Asia make sellers feel uneasy. Can the business model of "short video e-commerce" be established in Southeast Asia? Will TikTokshop have a turnaround in Indonesia? Can the development of e-commerce in Southeast Asia continue to grow at a high speed? Should Chinese and local sellers still have hope? A series of life and death questions are currently unanswered.

Daily Economic News

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.(Email:[email protected])