Exceeding expectations! TCL Technology's Q3 net profit in its display business increased to 1.8 billion yuan, and panel prices rose across the board

On the evening of October 27th, TCL Technology disclosed its third quarter report, stating that its performance has improved strongly against the backdrop of a slowdown in global economic growth. In the first three quarters, the company achieved a revenue of 133

On the evening of October 27th, TCL Technology disclosed its third quarter report, stating that its performance has improved strongly against the backdrop of a slowdown in global economic growth. In the first three quarters, the company achieved a revenue of 133.1 billion yuan, a year-on-year increase of 5.2%; The net profit attributable to shareholders of the listed company was 1.61 billion yuan, a year-on-year increase of 474%.

To the surprise of the market, the company's semiconductor display business not only turned losses, but also achieved a net profit of 1.82 billion yuan in the third quarter, despite the expected slowdown in the rise of TV panel prices. This means that the panel industry has returned to its profit range, and the performance of leading companies is accelerating to improve.

In the fourth quarter, the industry gradually entered the off-season for TV panel stocking. However, based on price observations in October, TV panel prices remained high and stable, without significant adjustments expected by the market. The profitability of panel manufacturers is highly resilient.

At the same time, mainstream market institutions are expected to gradually open a rebound window for mobile phone and laptop consumption starting from Q4, and small and medium-sized panels are expected to see a sustained rebound in prices. Top panel manufacturers such as TCL Technology and BOE are expected to continue to outperform previous market expectations in Q4.

TCL Technology and other panel leaders' Q3 performance exceeded expectations, while Q4 performance is still expected

Since the beginning of this year, under the influence of high inflation, geopolitical conflicts, and tight monetary policies, the global economic growth rate has significantly slowed down. Therefore, the reverse recovery of the panel industry in this round is commendable, but it also conforms to the normal trajectory of industrial pattern evolution.

According to the third quarter report of TCL Technology, its semiconductor display business achieved a revenue of 25.68 billion yuan in the third quarter, a year-on-year increase of 73.0%, and achieved a net profit of 1.82 billion yuan, turning losses into profits in a single quarter. It can be seen that the strong recovery of the semiconductor display business is the main reason for the improvement of the company's performance in the third quarter.

It should be noted that in the context of the strategic focus of panel factories shifting from market share to profit returns, the industry's supply and demand relationship is expected to remain stable for a long time. Panel prices have shifted from significant fluctuations in previous strong cycles to narrow fluctuations with reasonable profits, and the industry has entered a new stage of development.

The fourth quarter is gradually entering the off-season for TV stocking, but Lotu Technology's latest analysis suggests that although TV panel prices below 50 inches may face a slight decrease of around $2 in November, the decline is relatively mild and limited, and the overall operation will remain high. Especially, the prices of large-sized panels above 55 inches will be very strong, and the downward pressure can be ignored.

An analyst said, "The prices of large-sized TV panels will still remain high, while the prices of small and medium-sized panels are rebounding from the bottom. Overall, the average price performance of Q4 panels is likely to be stronger than Q3, continuing to maintain above the profit level line of mainstream panel manufacturers. Therefore, the overall performance of panel manufacturers, including TCL Technology, in Q4 is still highly anticipated and may continue to be stronger than market expectations

The prices of large, medium, and small-sized products have risen across the board, driving the industry's profit center upwards

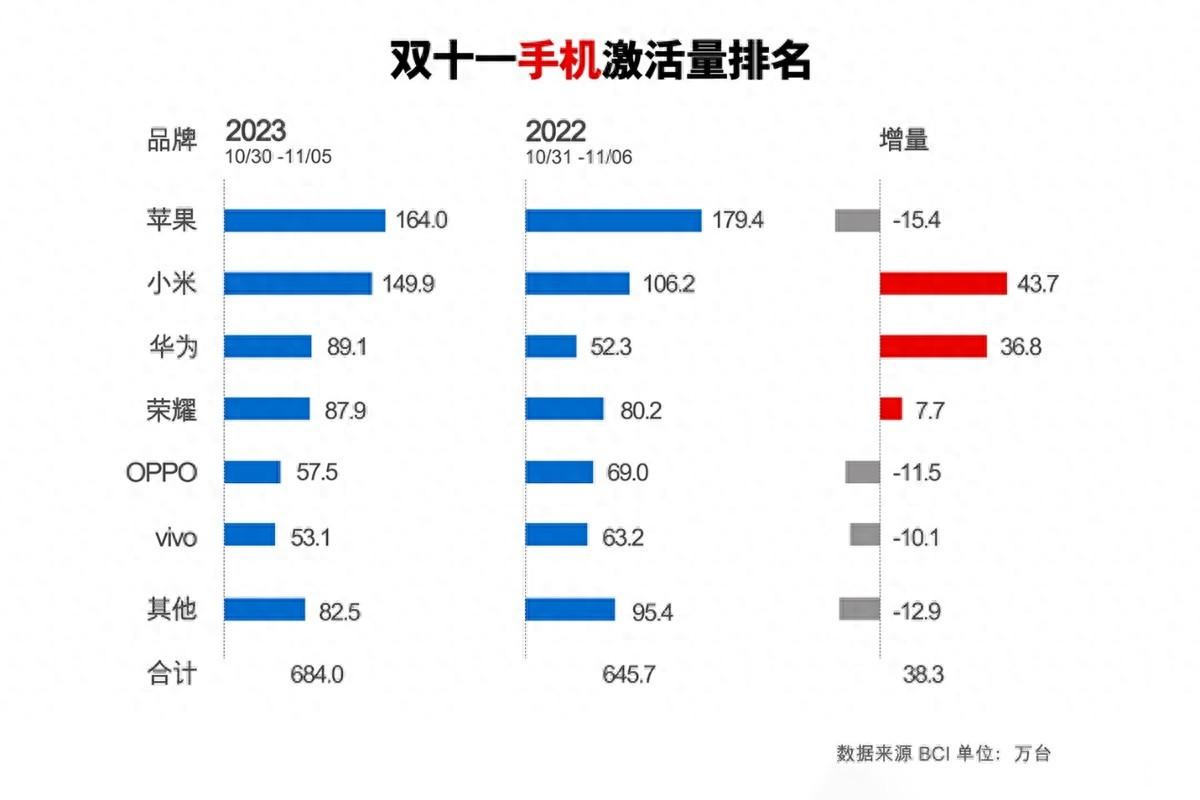

In terms of small-sized panels, the latest report from Qunzhi Consulting believes that in the fourth quarter, with the hot sales of flagship models such as Xiaomi 14, Huawei Mate60, and Apple iPhone 15 series, the demand for smart phone panels has significantly increased. The supply and demand environment for LTPS LCD and OLED panels in China is becoming tense, putting upward pressure on the prices of smart phone panels. It is reported that the price of flexible OLED panels in China has started to rise recently, with an increase of less than 10%.

From the perspective of panel factory shipment performance, according to StonePartners data, it is expected that the global flexible OLED market share will further change in Q3. TCL Huaxing, a subsidiary of TCL Technology, is expected to enter the top three globally with a market share of 9.9% and enter the top three for the first time. Its OLED business is entering a fast lane of development, fully benefiting from industry development.

In terms of mid size panels represented by tablets and laptops, Qunzhi Consulting predicts that as the global consumption season enters the fourth quarter, brands will actively start stocking, and there is a possibility of price increases for some specifications of panels. With the global decline in laptop shipments significantly narrowing to 9% in Q3, mainstream consumer electronics market research institutions including IDC and Gartner expect that the laptop market has started to bottom out since Q3, and it is likely to enter the stage of bottoming out and rebounding in the future.

Analysts believe that the gradual recovery of consumer spending such as laptops and smartphones is expected to provide further performance support to upstream panel industry leaders, including TCL Technology and BOE. The rebound horn for the small and medium-sized panel market has sounded, and this round of recovery may have strong sustainability and will not end soon.

The high prices of large-sized products have stabilized, while the prices of small and medium-sized products have continued to rebound. This means that a month ago, the pessimistic expectations of major institutions regarding the Q4 panel market prices showed clear signs of loosening. In this situation, top panel manufacturers such as TCL Technology and BOE are expected to continue to outperform market expectations in Q4.

Considering that 2024 is a year of concentrated hosting of multiple sports events, including top-level events such as the Paris Olympics, the European Cup, and the Copa America, it will effectively drive demand, indicating that panel manufacturers' performance will be more impressive next year. Huaxi Securities Research Report pointed out that driven by the price increase of LCD large-sized panels, the panel industry chain has a higher enthusiasm for profitability. It is expected that there will be a certain price increase for panel sizes of large, medium, and small sizes next year.

Disclaimer: The content of this article is sourced from the internet. The copyright of the text, images, and other materials belongs to the original author. The platform reprints the materials for the purpose of conveying more information. The content of the article is for reference and learning only, and should not be used for commercial purposes. If it infringes on your legitimate rights and interests, please contact us promptly and we will handle it as soon as possible! We respect copyright and are committed to protecting it. Thank you for sharing.(Email:[email protected])